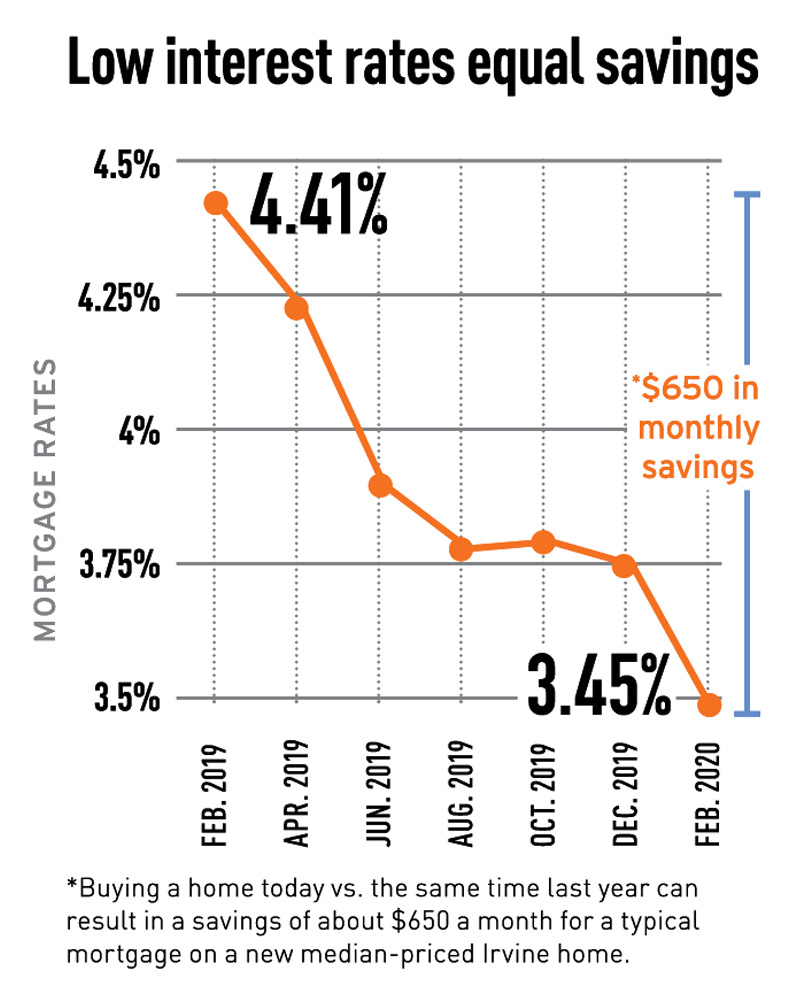

Mortgage interest rates dropped once again last month, reaching their lowest levels since fall 2016. According to the U.S. Federal Reserve, rates dropped to 3.45% – a near full-point reduction since the same time last year.

Mortgage interest rates dropped once again last month, reaching their lowest levels since fall 2016. According to the U.S. Federal Reserve, rates dropped to 3.45% – a near full-point reduction since the same time last year.

One percentage point may seem small, but it has a big impact on homebuying power and family savings.

“Compared to last year, today’s homebuyer is saving about $650 each month for a typical mortgage on an average-priced home in Irvine,” said

John Shumway, economist and principal with the Concord Group. ”Those savings, which total about $7,800 per year, can go to a 401(k), college fund or a bigger house. Families can save a lot when rates drop like this.”

For many families, Irvine is the ideal location to take advantage of interest-rate savings and added homebuying power.

Top-ranked master-planned community

In fact, for the ninth consecutive year, The Irvine Ranch ranks as California’s top-selling master-planned community, according to an annual report from John Burns Real Estate Consulting, released in January.

The Burns report cites several key factors that lead to a successful master-planned community, including creative design, exceptional amenities, cutting-edge health and wellness offerings, and access to employment – all central tenets of the Irvine Master Plan.

Other recent Irvine accolades include the top park system in America (Trust for Public Land); the safest large city in America (FBI statistics); and the No. 1-ranked public university in America (Money magazine).